Abstract

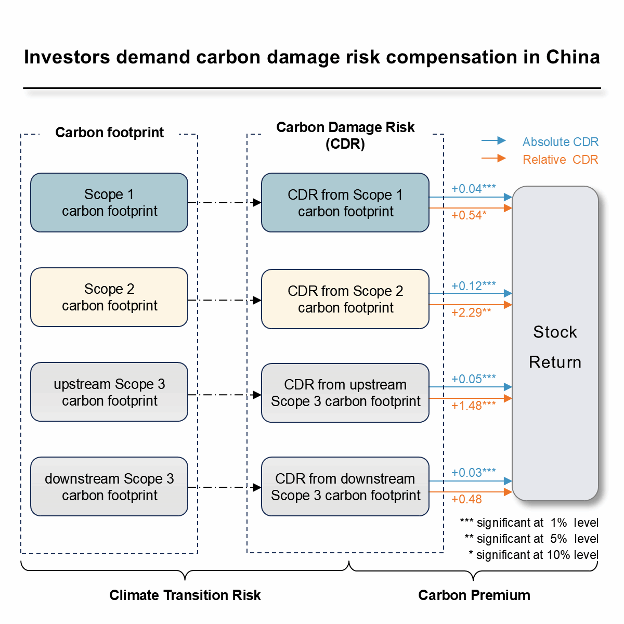

As climate awareness grows, investors are integrating climate performance into their investment decision-making processes to mitigate potential risks. This paper examines the societal costs associated with the carbon footprints of publicly listed companies in China and explores whether investors demand compensation for their exposure to risks associated with investments in assets with greater carbon damages. We find a continuous rise in the carbon footprints of Chinese listed companies, with a particularly noticeable increase following the COVID-19 pandemic. The carbon damages of Chinese listed companies are sourced mainly from their value chain emissions, with significant sectoral and regional heterogeneity. Finally, we observe a carbon damage risk premium throughout entire value chain when viewed from an absolute risk perspective. Even for less perceptible relative risks, we find that listed companies with greater scaled carbon damages originating from direct and upstream value chain carbon footprints are associated with higher expected returns.

Lu, Z., Zhang, Y., & Zhang, Z. (2025). Investors demand carbon damage risk compensation in China. iScience. 113534.

https://doi.org/10.1016/j.isci.2025.113534