Summary

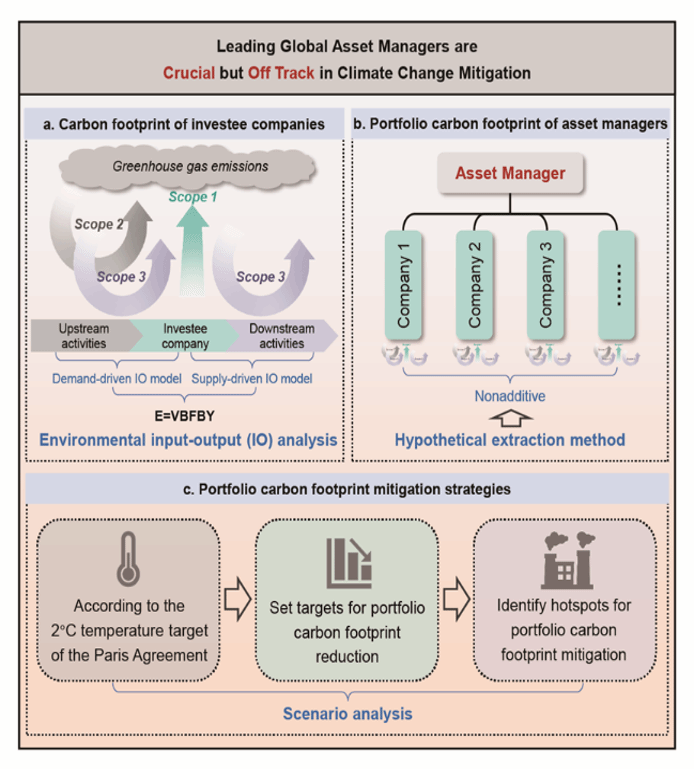

Financial institutions, especially leading asset managers that play critical roles in allocating financial flows, are essential for climate change mitigation. Herein, we evaluate portfolio carbon footprints, which are the greenhouse gas (GHG) emissions enabled by equity investment, of the 500 leading global asset managers. We find that the volume of financed GHG emissions increased from 8.0 billion tonnes CO2 equivalent (CO2e) in 2015 to 9.5 billion tonnes CO2e in 2021, accounting for approximately one-fifth of global GHG emissions. A scenario-based target setting for portfolio carbon footprints reveals that most of the leading global asset managers are not on the right track in fighting climate change, especially those in emerging countries. A limited proportion of the related equity holdings of carbon-intensive companies account for a greater share of the portfolio carbon footprint, representing targeted opportunities to curb the portfolio carbon footprint.

Z.K. Zhang*, J.Y. Li, X.Y. Wang, X.X. Chen, C.Z. Zheng. 2025. Leading global asset managers are crucial but off track in climate change mitigation. One Earth. 101267.

https://doi.org/10.1016/j.oneear.2025.101267